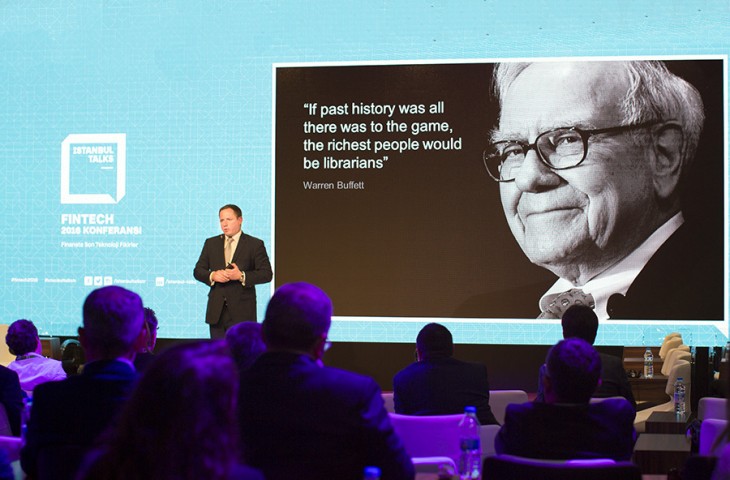

New trends in FinTech – Alastair Lukies United Kingdom Prime Minister’s Business Ambassador for FinTech

by 0

We see lots of P2P (peer-to -peer) lending which means the person to person lending. When people don’t feel like getting a good deal from the bank, they borrow money from other consumers.

We had a pleasant conversation with United Kingdom Prime Minister’s Business Ambassador for FinTech, Alastair Lukies at Istanbul Talks FinTech about the new trends in the finance sector.

Would you please tell us about the new trends in the finance industry?

I think we see obviously technology drive a lot of change. If you look at the payments industry, for example, we see people using their mobile phones to pay now whereas historically they used a card. So, I think that’s one area that’s of great interest m-commerce, m-payments. I think also we see lots of P2P lending which means a “person to person” lending. When people don’t feel like getting a good deal from the bank, they borrow money from other consumers. So, that’s quite a big trend now. Then obviously in emerging markets in parts of Africa or South America we see people get access to financial services for the first time because of technology rather than because of a bank.

You mentioned that three parameters were relevant in the new world. Those are money, people, and the mobility. Why is mobility that critical?

It’s a great question. I think because what a mobile phone does is, it gives you an interactive way of dealing with your finances. So, if you think of it before we had a card, cheque or cash but you couldn’t interact with those things whereas mobile phone can bring you special offers. It can see where your location is, it means that you can secure yourself using your thumbprint or a pin code, so the mobile phone brings the whole experience to life.

You also mentioned that m-commerce is everything coming together, we shall go to the consumers and shall not expect them to come to us. So, what are the new trends in m-commerce?

Great question. I think you have to imagine it’s a bit like televisions before remote controls. If you think of your bank as a television, and you only had a small number of channels, you had a branch, the Internet, and call-center but you had to go to that whereas with a mobile phone it comes to you. With the help of applications, you have the ability to order a taxi through Uber and pay for it without having to have cash. So, what m-commerce means to advertisers is retailers, banks and payment, all are coming together at the same time.

What would you recommend to the startups that are planning to do business in FinTech?

Well, I think the very important clue is, as they say, is in the name: FinTech, means financial services and technology. They have to understand financial services to apply the technology. I think when it comes to FinTech, they need to reimagine the way things are done completely and find the ways of doing them better than they’ve been done before.

Thank you very much for your contribution.

My pleasure.

You can watch an interview with Alastair Lukies, United Kingdom Prime Minister’s Business Ambassador for FinTech below.